Data Procurement Methodology

“You can have data without information, but you cannot have information without data.” - Daniel Keys Moran

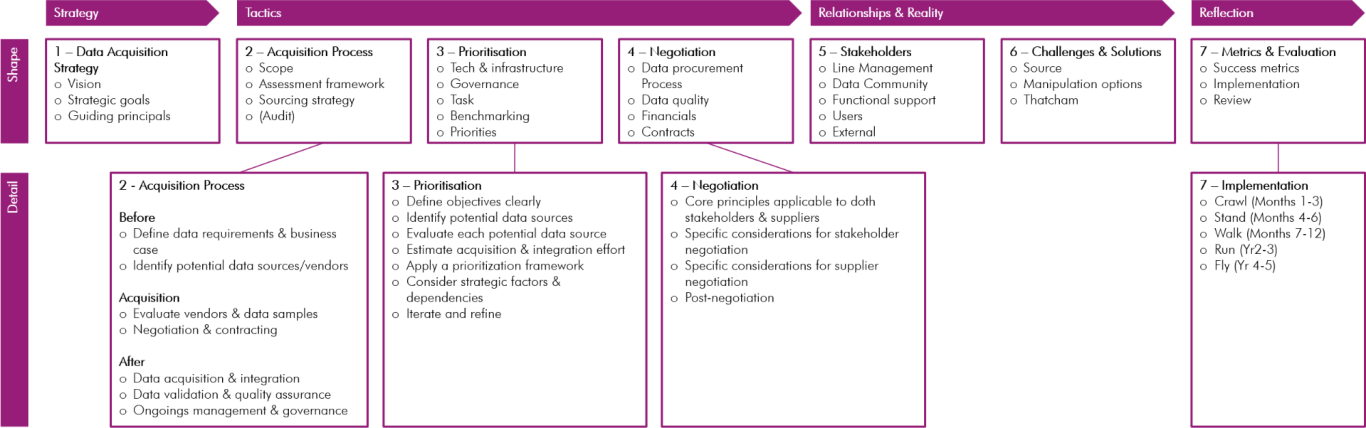

1 Creation of Data Acquisition Strategy: Outline your approach to developing a comprehensive strategy.

Empowering with timely, accurate, relevant, and ethically sourced data, that enables data-driven decisions and competitive advantage across current and future business functions.

Vision & Goals

Empowering Thatcham Research with timely, accurate, relevant, and ethically sourced data, that enables data-driven decisions and competitive advantage across current and future business functions.

Strategic Goals

Reviewed annually, or more frequently if significant changes occur in business objectives, regulations, or the data market.

o Support key businesses initiatives with necessary data sets, e.g., Personalisation, product development/creation, new markets.

o Improve the quality, consistency, and reliability of data used for analytics and operations.

o Ensure all data acquisition activities are compliant with relevant regulations (e.g., GDPR, DPA), ethical standards, company standards.

o Optimise the cost-effectiveness of data acquisition efforts.

o Foster a data-aware culture where data needs are proactively identified and addressed.

o Establish clear processes and responsibilities for managing the data acquisition lifecycle

Guiding Principals

All data acquisition activities will adhere to the following principles:

o Business Value Driven: Data acquisition efforts must be clearly linked to specific business needs and demonstrate potential ROI.

o Quality First: Prioritise data accuracy, completeness, timeliness, consistency, and relevance. Implement robust quality checks.

o Ethical & Compliant: Ensure all data is sourced and handled ethically and in full compliance with legal and regulatory requirements (including data privacy).

o Security & Privacy by Design: Integrate security and privacy considerations into every stage of the acquisition process.

o Transparency: Maintain clear documentation regarding data sources, lineage, acquisition methods, and usage rights.

o Efficiency & Scalability: Utilise efficient processes and technologies that can scale with evolving data needs.

o Collaboration: Encourage cross-functional collaboration to identify data needs and leverage existing internal data assets effectively.

2. Acquisition Process: Detail the steps you would take to acquire data effectively

Scope

Covers structured, semi or unstructured data acquired via external procurement, open data initiatives, partnerships and direct collection, e.g.:

o Third-Party Data: Data obtained from external vendors, partners, or open sources.

o Financial Data: Market indices, economic indicators, company financial information.

o Geospatial Data: Location-based information.

o Internally Generated Data: Data created through business operations, surveys, research, etc.

o Operational Data: Processes, performance (tests) metrics, logistics, sensor data (IoT).

o Customer Data: Demographics, behaviour, transactions, interactions.

o Market & Competitor Data: Trends, market share, competitor activities, pricing.

Assessment Framework

First an audit of current data, processes and documentation. Then a systematic process will be used to identify and prioritize agreed data needs:

o Link to Business Objectives: Start by identifying the key business questions, strategic initiatives, or operational challenges that require data.

o Stakeholder Consultation: Engage with business units, data analysts, and data scientists to understand their specific data requirements, including desired attributes, frequency, granularity, and quality thresholds.

o Gap Analysis: Assess existing internal data assets against identified needs to pinpoint gaps where external or new internal data is required.

o Prioritisation: Prioritize data needs based on potential business impact, urgency, feasibility, and alignment with strategic goals.

o Documentation: Document approved data requirements, including specifications and intended use cases.

Sourcing Strategy

Based on the identified needs, the following sourcing options will be evaluated:

Internal Sources:

o Leverage Existing Systems: Maximize the use of data already available within internal systems (CRM, ERP, operational databases, data warehouses/lakes, logs).

o Promote Data Sharing: Establish mechanisms and policies to facilitate secure and governed data sharing across departments.

External Sources:

o Commercial Data Vendors/Brokers: Identify and procure data from reputable third-party providers. This requires following the formal Data Procurement Process

o Open Data Sources: Utilize publicly available data from government agencies (e.g., Office for National Statistics, data.gov.uk), academic institutions, and non-profits. Implement validation processes due to potential variability in quality.

o Data Partnerships: Explore strategic partnerships for mutually beneficial data sharing arrangements (subject to strict legal and ethical review).

o Direct Collection/Generation: Acquire data through methods like web scraping (ensuring compliance with terms of service and legal constraints), surveys, IoT sensors, or commissioned research. Establish clear standards for collection methodology and consent management where applicable.

o Source Evaluation Criteria: Select sources based on: Data Relevance & Coverage, Quality & Accuracy, Timeliness & Frequency, Cost & Licensing Terms, Vendor Reputation & Reliability, Compliance & Security Posture, Technical Integration Feasibility.

Before

Define Data Requirements & Business Case:

o Identify the Need: Clearly articulate the business problem or opportunity that requires external data. What specific questions need answering? What goals will this data help achieve?

o Specify Data Attributes: Define the exact data points needed (e.g., customer demographics, company firmographics, market trends, geospatial data). Specify the required format, granularity, geographic coverage, and historical depth.

o Establish Quality Metrics: Define acceptable levels of accuracy, completeness, timeliness, and consistency.

o Gap Analysis: Is it a nett new need? Could use current data in a new way?

o Budget & ROI: Determine the budget available for data acquisition and estimate the potential return on investment.

Identify Potential Data Sources/Vendors:

o Market Research: Search for potential data providers, brokers, aggregators, or open data sources that offer the required data. This can involve online searches, industry reports, data marketplaces, and professional networks.

o Source Types: Consider various source types: commercial data vendors, government agencies (open data), academic institutions, non-profits, data marketplaces, etc.

Acquisition

Evaluate Vendors & Data Samples:

o Initial Screening: Create a shortlist of vendors based on their offerings, reputation, and initial alignment with requirements.

o Request for Information/Proposal (RFI/RFP): Formally request detailed information from shortlisted vendors about their data, methodology, pricing, SLAs, and compliance measures.

o Data Sample Review: Obtain and meticulously evaluate sample datasets from potential vendors. Assess against the pre-defined quality metrics (accuracy, completeness, format, timeliness).

o Due Diligence: Investigate the vendor's reputation, data collection methods (ensure ethical and legal sourcing), data security practices, compliance certifications (e.g., GDPR, CCPA), customer support, and financial stability. Check references if possible.

Negotiation & Contracting:

License Agreement: Carefully review and negotiate the terms of the data license agreement. Pay close attention to:

o Scope of Use: How and where can the data be used? Are there restrictions on sharing, resale, or derivative works?

o Data Delivery: Method (API, FTP, file transfer), frequency, and format.

o Service Level Agreements (SLAs): Guarantees regarding data quality, update frequency, and system uptime (for API access).

o Compliance & Privacy: Clauses related to data privacy regulations and security obligations.

o Term & Termination: Duration of the agreement and conditions for renewal or termination.

o Liability & Indemnification: Responsibilities of each party.

Pricing Models: Understand and negotiate the pricing structure (e.g., subscription, per-record, usage-based).

After

Data Acquisition & Integration:

o Technical Setup: Establish the technical means to receive the data (e.g., configure API connections, set up secure file transfer protocols).

o Data Ingestion: Receive the data according to the agreed schedule and method.

o ETL/ELT Process: Develop processes (Extract, Transform, Load or Extract, Load, Transform) to clean, format, and integrate the procured data into the organization's internal systems (e.g., data warehouses, data lakes, CRM systems).

Data Validation & Quality Assurance:

o Initial Validation: Upon receipt, verify the data against the agreed-upon specifications and quality metrics. Check for completeness, accuracy, and formatting issues.

o Ongoing Monitoring: Continuously monitor the quality and timeliness of incoming data feeds.

Ongoing Management & Governance:

o Vendor Relationship Management: Maintain communication with the data vendor regarding performance, issues, and potential future needs.

o Usage Monitoring: Track how the data is being used internally to ensure compliance with the license agreement and to assess its value.

o Renewal/Termination Strategy: Plan for contract renewals or termination well in advance, reassessing needs and exploring alternatives if necessary.

o Data Governance: Ensure the procured data is managed according to internal data governance policies regarding access control,security, retention, and disposal.

3. Prioritisation: Explain how you would prioritise data sources and acquisition efforts

Potential Limitations

Tech & Infrastructure

Support data acquisition with appropriate technology:

o Data Catalogue: To inventory data assets (internal and procured) and make them discoverable.

o ETL/ELT Tools: For efficient data ingestion, transformation, and integration.

o Data Storage: Data Lakes, Data Warehouses, or appropriate databases to store acquired data.

o API Management: To manage connections for data acquisition via APIs.

o Data Quality Tools: To automate profiling, cleansing, and monitoring.

o Security Infrastructure: Firewalls, encryption, access controls to protect data.

Governance

Data acquisition must be governed and compliant:

o Data Governance Framework: Adhere to the organization's overall data governance policies and standards. Establish a Data Governance Council or equivalent body with oversight.

o Roles & Responsibilities: Clearly define roles – see Stakeholder Data Masters

o Policy Adherence: Ensure compliance with internal policies (e.g., data security, acceptable use) and external regulations (e.g., GDPR, UK Data Protection Act 2018, industry-specific rules).

o Privacy Impact Assessments (PIAs): Conduct PIAs for acquisitions involving personal data, especially from new sources or for new uses.

o Ethical Review: Implement a process for ethical review of data sources and intended uses, particularly for sensitive data or data generated via methods like web scraping.

o Contract Management: Maintain a central repository and review process for data licenses and vendor agreements.

o Audit Trails: Maintain logs of data acquisition activities for traceability and compliance.

Roadmap

Task

o Input comes from all stakeholders, set within line-management objectives and are surfaced by events.

o Connect into the right forums/meeting to collect or be aware of needs. Create on-line form for others.

o Correctly collecting and understanding each need.

o Ensure the expectation of turnaround matches the reality.

Benchmarking

o Attribute the value the next capabilities and the costs (time/money) that each will take.

o Rolling up similar or aligned needs would be efficient.

Priorities

o Arrange the tasks in an Effort-Value grid, with awareness of limiting dependants, to suggest a delivery Roadmap.

o Agree/sign off Roadmap from line-management and major Stakeholders.

o Communicate to all clients where their ask is in the backlog.

o Expect to flex.

Method

Prioritising between data sources and the associated acquisition efforts is crucial for efficient data strategy and project execution. It involves balancing the potential value of the data against the resources required to obtain and use it. By systematically evaluating potential data sources based on their value, quality, cost, and strategic fit, you can effectively prioritize your acquisition efforts and maximize the return on your data investments

A. Define Objectives Clearly

o What specific business questions are you trying to answer?

o What specific decisions does this data need to support?

o What Key Performance Indicators (KPIs) are you trying to influence?

o Why? Knowing the 'why' helps determine the value of potential data sources. Data is only valuable if it helps achieve a specific goal.

B. Identify Potential Data Sources

Brainstorm and list all conceivable data sources relevant to your objectives. Categorise them:

o External (Structured): Third-party data providers (market research, demographics), partner data, public APIs (government data, social media APIs).

o External (Unstructured): Social media comments, news articles, customer reviews, web scraping.

o Generated: IP created data, surveys, interviews, sensor data (IoT).

o Internal: CRM, ERP, transaction logs, website analytics, internal databases, employee surveys.

C. Evaluate Each Potential Data Source:

Assess each source against key criteria with a scoring system (e.g., 5 high to 1 low, 0 absent)

Relevance/Potential Impact (Value): Score = High (critical for objective) to Low (tangential).

o How directly does this data address your objectives?

o How significant is the potential insight or decision-making improvement it could enable?

o Does it offer unique information not available elsewhere?

Data Quality & Reliability: Score = High (trustworthy, complete, timely) to Low (unreliable, requires significant cleaning).

o Accuracy: Is the data correct?

o Completeness: Are there significant gaps?

o Timeliness/Frequency: Is the data current enough, and updated often enough for your needs?

o Consistency: Is the data format and meaning consistent over time and across records?

o Provenance: Do you trust the source and know how the data was collected?

Accessibility & Ease of Acquisition: Score = High (easy to access) to Low (significant technical/legal hurdles).

o Are there technical barriers (complex APIs, difficult formats)?

o Are there legal/contractual barriers (permissions, licenses, privacy regulations)?

o How readily available is the data?

D. Estimate Acquisition & Integration Effort (Cost/Time)

Score: High (resource-intensive, costly, long time) to Low (quick, cheap, minimal resources). For each source deemed potentially valuable and reasonably accessible:

o Acquisition Cost: Direct costs like subscription fees, purchase price, API call charges.

o Technical Effort: Time/resources for development (scripts, API integration), infrastructure setup (storage, processing).

o Data Preparation Effort: Time/resources for cleaning, validating, transforming, structuring, and integrating the data. This is often underestimated.

o Maintenance Effort: Ongoing resources needed to keep the data flowing and integrated.

o Skills Required: Do you have the necessary expertise in-house?

E. Apply a Prioritization Framework

Combine the evaluations from steps 3 and 4. Common methods include:

Value vs. Effort Matrix: Plot sources on a 2x2 grid: (High/Low Value) vs. (High/Low Effort).

o Priority 1: High Value / Low Effort (Quick Wins): Target these first.

o Priority 2: High Value / High Effort (Major Projects): Strategically important, require planning and resource allocation.

o Priority 3: Low Value / Low Effort: Only pursue if resources are abundant or if they enable future high-value work.

o Priority 4: Low Value / High Effort: Generally, avoid these unless strategically imperative or set objectives

Weighted Scoring Model:

o Assign weights to your criteria (Value, Quality, Effort, etc.) based on strategic importance.

o Calculate a total score for each data source.

o Rank sources based on their scores.

RICE Framework (Adapted): Score = (Reach * Impact * Confidence) / Effort

o Reach: How many users/processes will this data impact?

o Impact: How significant is the improvement/insight? (Use your Value score)

o Confidence: How confident are you in the estimated reach, impact, and effort? (Factor in Quality/Reliability)

o Effort: Use your Effort score.

F. Consider Strategic Factors & Dependencies

o Urgency: Are there immediate business needs or deadlines driving the need for specific data?

o Dependencies: Is one data source required before another can be effectively used or interpreted? (e.g., Need customer master data before analysing transaction data).

o Strategic Alignment: Does acquiring this data align with longer-term company goals or data strategy initiatives?

o Risk: Consider privacy (GDPR, CCPA), security, ethical implications, and potential data bias associated with each source. High-risk sources might require more scrutiny or be deprioritized.

G. Iterate and Refine

o Start with the highest priority sources. Sometimes a "Minimum Viable Data" approach is best – get just enough data to test a hypothesis or prove value before investing heavily.

o Re-evaluate priorities regularly. Business needs change, new data sources become available, and the actual effort/value might differ from initial estimates.

o Document your prioritisation decisions and rationale.

4. Negotiation: Discuss your approach to negotiating with data providers and stakeholders

Details

Data Procurement Process

Acquisition of data from commercial vendors will follow a defined process:

o Define Requirements & Budget.

o Identify Potential Vendors.

o Vendor Evaluation & Due Diligence (incl. sample review, security/compliance checks).

o Negotiation & Contracting (focus on usage rights, SLAs, liability, privacy).

o Data Acquisition & Integration.

o Validation & Quality Assurance.

o Ongoing Vendor & Contract Management.

Data Quality

Ensuring data quality is integral to this strategy:

o Quality Dimensions: Define and measure data quality across key dimensions: Accuracy, Completeness, Consistency, Timeliness, Validity, Uniqueness.

o Quality Checks: Implement data quality checks at various stages: during ingestion, post-integration, and periodically.

o Profiling & Cleansing: Utilize tools and techniques for data profiling to understand quality issues and for data cleansing to rectify them.

o Monitoring & Reporting: Establish dashboards and reports to monitor data quality metrics over time.

o Feedback Loop: Create mechanisms for data users to report quality issues.

o Ownership: Assign clear ownership for data quality for key datasets. See Data Masters in Stakeholders.

Documents

Financials

o Budget – Understand who owns what budgets, who pays for what, what’s the current.

o Current Agreements cost and ownership.

o Next budget process. Where is it right now/next, what’s the phases.

o New cost process. How to pitch for support for new asks.

Contracts

o Legal – process and stakeholders.

o Procurement – process and stakeholders.

o Agreement – process and stakeholders.

o Signatures – process and stakeholders

Method

Negotiation is a communication process, to reach the agreement that finds the solution that meet objectives, manages relationships, and creates value. Successful negotiation with supplier often focus more sharply on commercial terms and contracts, where stakeholder negotiations frequently involve navigating diverse interests and building consensus or support.

Core Principles Applicable to Both Stakeholders & Suppliers

Preparation is Paramount

o Define Your Objectives: What do you absolutely need (must-haves)? What would be nice to have (wants)? What is your ideal outcome?

o Know Your BATNA (Best Alternative To a Negotiated Agreement): What will you do if no agreement is reached? This defines your walk-away point and strengthens your position.

o Research the Other Party: Understand their goals, interests, potential constraints, priorities, and possible BATNA. What pressures are they under? What is their negotiation style?

o Identify Potential Issues & Options: Anticipate areas of agreement and disagreement. Brainstorm potential solutions and concessions.

o Establish Authority: Know who has the authority to make decisions on both sides.

Effective Communication

o Active Listening: Truly understand the other party's perspective, needs, and concerns before responding.

o Clear Articulation: State your position, interests, and proposals clearly and concisely. Avoid ambiguity.

o Asking Questions: Use open-ended questions to gather information and clarify understanding.

o Managing Emotions: Stay calm, professional, and objective, even during difficult discussions.

Focus on Interests, Not Just Positions

o A position is what someone says they want (e.g., "I need a 10% discount").

o An interest is the underlying reason why they want it (e.g., "I need to meet my budget target").

o Understanding interests opens up more creative solutions that can satisfy both parties.

Relationship Management

o Negotiation impacts relationships. Aim for fairness and respect, especially if you need an ongoing positive relationship (crucial for both long-term suppliers and key stakeholders).

o Building trust and rapport can facilitate smoother negotiations and better outcomes.

Strategies & Tactics

o Win-Win (Integrative Bargaining): Focus on finding solutions that create value for both sides ("expanding the pie"). Best for long-term relationships.

o Win-Lose (Distributive Bargaining): Focus on claiming value from a fixed set of resources ("dividing the pie"). Can be necessary but may damage relationships.

o Identify the ZOPA (Zone of Possible Agreement): The range where an agreement is possible, falling between each party's walk-away points.

o Anchoring: Making the first offer can influence the negotiation range, but do it carefully, based on research.

Specific Considerations for Stakeholder Negotiation

o Who are they? Stakeholders are individuals or groups with an interest in your project or organization's success. They can be:

o Internal: Employees, management, board members, different departments.

o External: Customers, communities, government bodies, investors, regulators.

o Diverse Interests: Stakeholders often have varied, sometimes conflicting, interests and levels of influence. Negotiation might involve balancing these competing demands.

o Focus: Often revolves around project scope, timelines, resources, policy changes, managing expectations, gaining buy-in, or resolving conflicts impacting the organization or community.

o Communication Channels: May require formal presentations, group meetings, or one-on-one discussions depending on the stakeholder.

o Goal: Often about alignment, consensus building, securing support or resources, and maintaining reputation or social license to operate.

Specific Considerations for Supplier Negotiation

o Who are they? External entities providing goods or services.

o Focus: Typically centres on commercial terms:

o Price and Payment Terms

o Quality Standards and Specifications

o Delivery Schedules and Logistics

o Contract Length and Renewal Clauses

o Volume, Discounts, Rebates

o Warranties, Liability, and Risk Allocation

o Intellectual Property Rights

o Service Level Agreements (SLAs)

o Goal: Secure reliable supply of necessary goods/services at the best possible total value (which includes price, quality, reliability, innovation potential, risk mitigation), often formalized in a legally binding contract.

o Supplier Relationship Management (SRM): Negotiation is part of a broader strategy. Is this a purely transactional relationship or a strategic partnership? Collaborative approaches with key suppliers can lead to innovation and shared benefits.

o Market Context: Supplier negotiations are heavily influenced by market conditions (e.g., supply/demand, commodity prices, competition).

Post-Negotiation

o Formalise the Agreement: Ensure all agreed points are clearly documented (e.g., in meeting minutes, contracts).

o Communicate Outcomes: Inform relevant parties about the agreement.

o Implement & Monitor: Put the agreement into action and track performance against it.

o Maintain the Relationship: Continue communication and address any issues that arise during implementation.

5. Stakeholders: Outline key stakeholders involved in the data acquisition process and your engagement approach. Roles, Responsibilities & Engagement

Line Management: Facts, details, advice, decisions

o Head of Data & Analysis - align to needs and set objectives

o Enterprise Data Manager - assist with adherence to data policies, data migration and transfer.

o Wider Team/Department: - will surface needs from events and support the ingestion and application of deliverables

Data Community: Inform, communicate, awareness

o Data Governance Lead/Council: Defines policies and standards; oversees compliance.

o Data Stewards: Responsible for specific data domains; define quality rules; approve acquisition for their domain.

Functional support: Specs, agile, processes

o Data Engineering/IT: Implement and manage technical infrastructure; integrate data.

o Procurement Team: Manages vendor negotiation and contracting process.

o Legal & Compliance Team: Provides guidance on regulations, contracts, and ethics; reviews PIAs.

o Finance Team: facilitates set up and payments

Users: Need, use, consensus, support, value

o Business Units/Data Consumers: Identify data needs; participate in validation.

o Data Analysts/Scientists: Use the acquired data; provide feedback on quality and relevance.

External: Negotiation, SLA, terms

o Data Providers: provide income data

o Data Users: uses outgoing data

6. Challenges & Solutions

Data acquisition comes with a significant set of challenges. Overcoming these challenges requires a well-defined strategy, careful planning, robust governance, appropriate technology, and ongoing management.

Source:

o Compliance, Legal, and Ethical Issues: Navigating the complex web of regulations (like GDPR, the UK Data Protection Act 2018, CCPA) is critical, especially when dealing with personal data. Ensuring data is sourced ethically, managing consent, understanding complex license agreements, and handling cross-border data transfers pose significant challenges. Awareness of the actuality v standards and discuss differences.

o Finding Relevant and Reliable Sources: Identifying the right data sources that meet specific business needs can be difficult. The market can be fragmented, and evaluating the reliability and reputation of vendors requires thorough due diligence. Well understood sources and manipulations are best. May have to layer up data and document the rules of comparison.

o Vendor Lock-in: Relying heavily on a single data provider can create dependency and make it difficult or costly to switch vendors later if needed. Having a Plan B for the data aligned on the most.

o End of Life/next generation: Laws and business models change. Plan B again, and look for those small but emerging data sources, fields or variables.

o Cost or Opportunity Cost: Acquiring external data, especially high-quality, specialized datasets, can be expensive. Costs include licensing fees, subscription charges, and potentially usage-based pricing. There are also internal costs for infrastructure, integration, and personnel to manage the process. High cost must produce high value, so when these move plan to make more value and/or lower the costs – or budget for reality.

o Data Quality and Consistency: Ensuring the accuracy, completeness, timeliness, and consistency of acquired data is a major hurdle. Data from different sources may have varying formats, definitions, and levels of reliability, requiring significant effort in cleaning, validation, and standardization. "Garbage in, garbage out" is a real risk. Understand and spec well and make sure they are adhered to. Monitor and report issues, errors and quality topics to stop the rot or claw back costs.

o Data Volume, Velocity, and Variety (The 3 Vs): Organizations often need to acquire large volumes of data (Volume), sometimes arriving at high speed (Velocity, e.g., real-time streams), Data Lag, and in various formats (Variety, e.g., structured tables, unstructured text, images). Handling these aspects requires robust infrastructure and processing capabilities. Timing seems to always be an issue around data – set expectations and monitor what is aligning to SLAs.

o Scalability: Acquisition processes and infrastructure must be able to scale as data needs grow or change over time. What works for a small dataset might not work for significantly larger ones. A great problem to have but cost may not be linear so look for Plan B options.

Manipulation Options

o Overlaps, Duplicates – Which to choose as the master? Rules, rationality and documentation.

o Integration Complexity: Getting acquired data into your existing systems (data warehouses, lakes, applications) can be technically challenging. It often involves building and maintaining complex ETL/ELT pipelines, handling different data formats and APIs, and ensuring compatibility. Keep the experts and practitioners advises and get their approval of any complexities and the solutions.

o Use v Expectation. Good, Fast, Cheap trade-offs. Cheap is never the best outcome, as that implies slow and bad. I tend to do a (fast) soft launch to learn how to ‘up’ the quality.

You

o Keeping Pace with Changing Needs: Business requirements evolve, meaning the data needed today might differ from what's needed tomorrow. The acquisition strategy needs to be agile enough to adapt. Be the data futurologist.

o Internal Skills Gap: Effective data acquisition requires a mix of skills, including data engineering, legal expertise, vendor management, and domain knowledge, which may not always be readily available internally. Flag the needs in the roadmap and be willing to flex timing.

o Organizational Silos: Lack of communication and collaboration between different departments can lead to duplicated acquisition efforts or failure to leverage internally available data effectively. Comms between people and project is key. Have a comms strategy.

o Data Security: Protecting acquired data, both during transit from the source and once stored within the organization, is paramount. Assessing and ensuring the security practices of third-party vendors is also a key challenge. Lean into the experts in the company and never take shortcuts.

7. Metrics & Evaluation. What does the success in your role looks like in Y1, Y3 and Y5…

Metrics that Matter

The success of this strategy will be measured by:

o Data Quality Improvement: Measured improvements in key quality dimensions for acquired data. Use/Value, Consistency… (0-3 scores) .

o Time-to-Value: Reduction in time taken to acquire and make data available for use. Days per stage and overall.

o Cost Optimization: Efficiency gains and cost management in data procurement. Total Cost, Cost per use.

o User Satisfaction: Feedback from data consumers on the relevance and accessibility of acquired data. Qualitative and Quantitative survey feedback crosstabs and year-on-year changes.

o Compliance Adherence: Audit results and number of compliance issues related to data acquisition. Likelihood v Impact scores. Outcome log

o ROI of Data Initiatives: Contribution of acquired data to the success of specific business projects. £ Value enabled. % year on year and against market conditions.

Implementation

Crawl (Months 1-3):

o Flesh out the detail in the presentation, taking advice, understanding gaps.

o Audit of current data, processes and documentation.

o Establish governance, roles and requirements.

o Communicate strategy and processes.

o Conduct initial high-level Data Needs Assessment across key business units.

o Publish 1yr Roadmap and set expectations.

o Deliver 1st quick-win of current data acquisition in play.

Stand (Months 4-6):

o Develop detailed acquisition Policies and procedures.

o Select/Configure initial technology (e.g., Data Catalogue pilot).

o Deliver 2nd and 3rd quick-win of current data acquisition in play.

o 1st Major project will be in process

Walk (Months 7-12):

o Refine processes based on pilots.

o Roll out technology and training.

o Begin broader implementation based on prioritized needs.

o Buildout Yr 2+ Roadmap

o Start delivering first parts of Roadmap.

Run (Year 2-3):

o Reliably delivery to Roadmap.

o Continuous monitoring, review, and refinement of the strategy, processes, and technology based on performance and evolving business needs.

Fly (Year 4-5):

o Incremental improvements, efficiency and effectiveness.

o Next generation needs and data value.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.